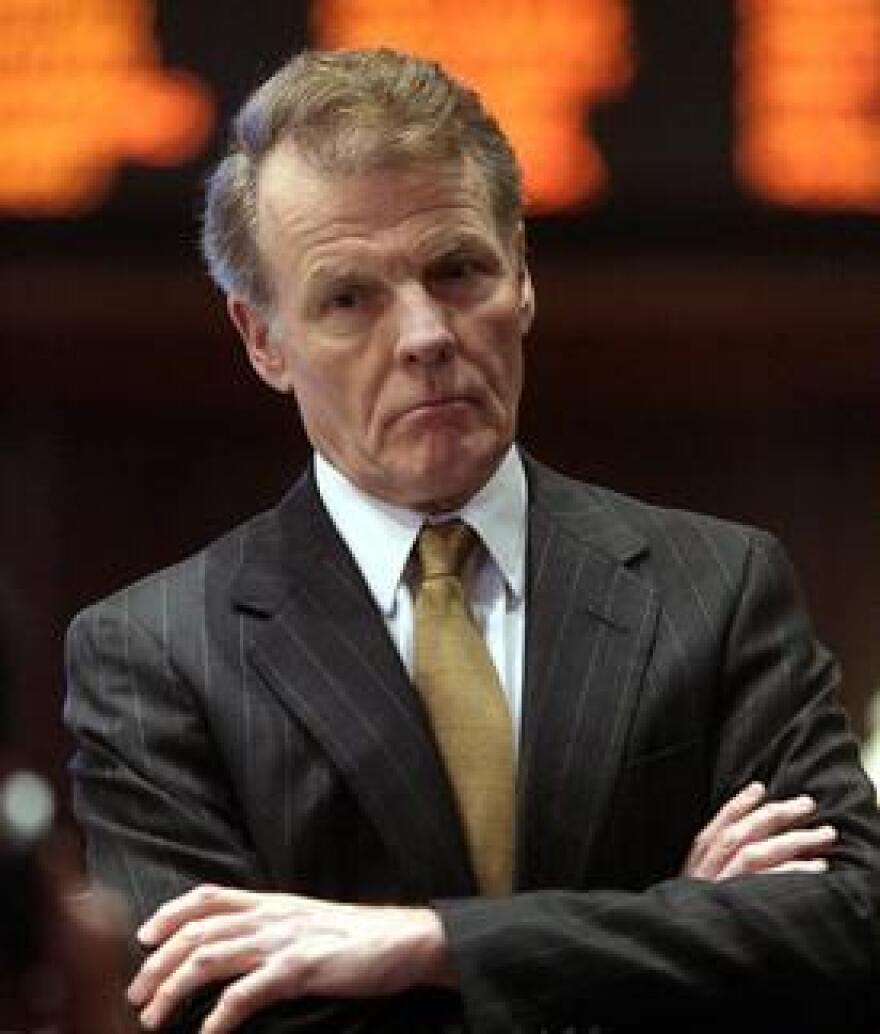

House Speaker Michael Madigan wants to cut the state's corporate tax rate in half. It's an apparent about face on tax policy that's left some Republicans scratching their heads.

Madigan says his proposal aims to create a friendlier business climate in Illinois. Corporations would pay a 3.5 percent tax, down from the current 7 percent.

It's a sharp turn from three years ago when Madigan pushed to increase the corporate tax rate along with the individual income tax.

House Minority Leader Jim Durkin says his fellow Republicans are encouraged by the proposal, but are wary of the speaker's intentions.

"I'm a bit confused by it but I'm welcome to discussion and find out exactly how this is going to play into our budget this next year," he said.

But next year's budget negotiations are months away. If Madigan's proposal passes, it would be retroactive to Jan. 1, leaving a large hole in this year's budget.

Madigan's spokesman says he has no idea how much tax money Illinois would lose, and neither does Durkin.

"You're asking the wrong person. I'd like to have the Speaker explain that."

In a statement, Madigan says he hopes the tax cut will encourage businesses to add more "good paying jobs."

“For many years, we have listened to employers about the best manner to improve the business climate," he said. Cutting the corporate income tax rate is another step I am asking the legislature to consider."